Preserving Your Credit Score: 7 Things To Watch Out For

Reviewed by: Fibe Research Team

- Updated on: 10 Apr 2023

Reviewed by: Fibe Research Team

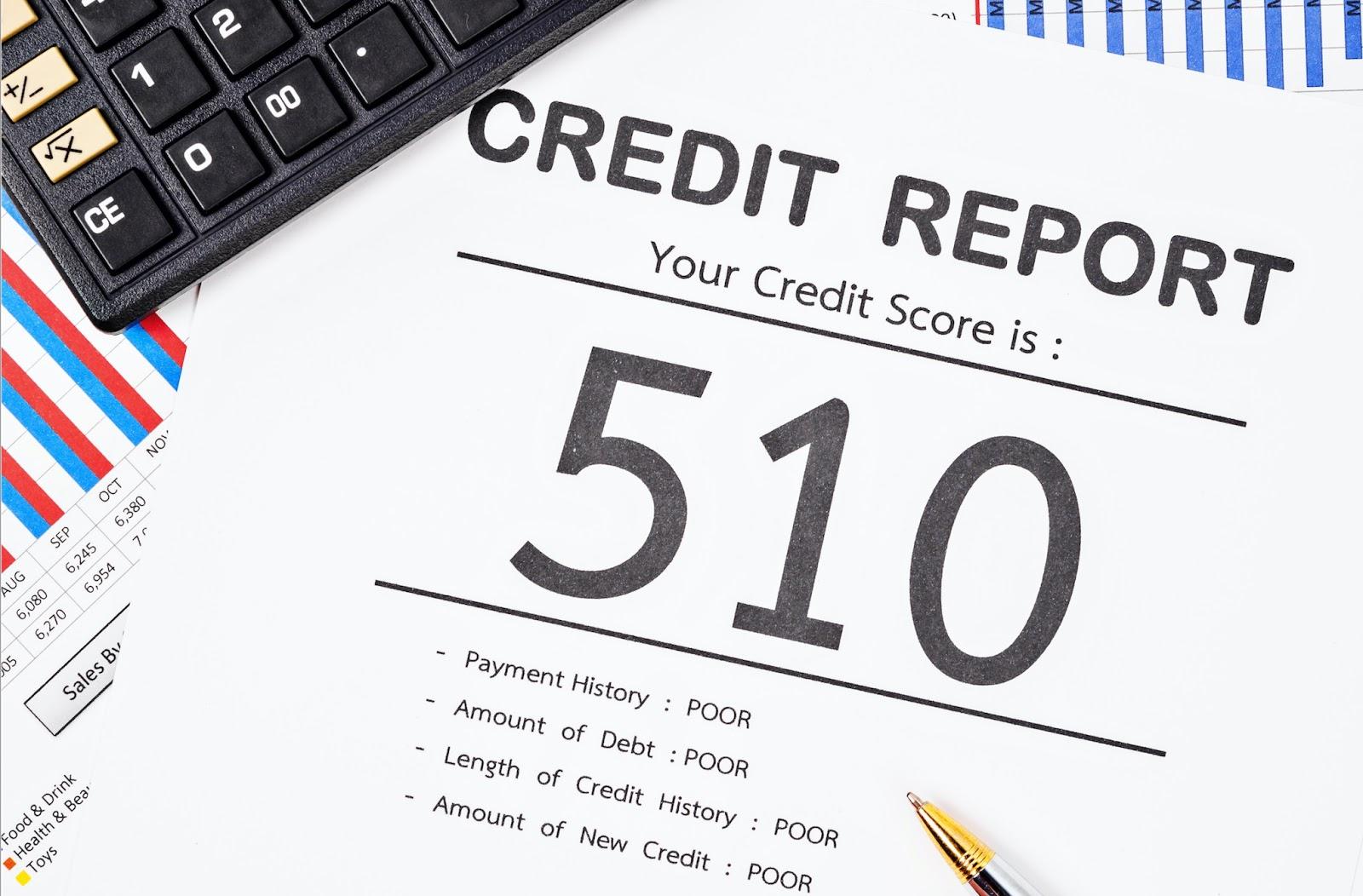

Imagine being able to borrow money without any hassles or unruly paperwork, so that you could buy your dream car or house. However, reality is far from such a scenario. Borrowing money from the bank depends on a number of factors – the most important being your credit score. A credit score is an indicator of your reliability and financial situation. Lenders assess your risk as a borrower by putting together the information in your credit report and credit score. A high score results in banks lending you money without much doubt and interest. A low credit score, on the other hand, comes with its long list of problems including higher interest on loans, high insurance premiums, and difficulty in being able to buy or rent houses and cars. We’ve previously discussed 5 ways to improve your credit score. This time, here are seven ways to preserve your credit score and prevent it from dropping –

Credit utilisation is calculated as the ratio of your outstanding balance to your credit limit. If your credit utilisation is high, it could impact your credit score. If you use too much credit, the possibility of you repaying the money you borrow is expected to decrease. A higher utilisation could ultimately result in you defaulting on your credit obligations. A low credit utilisation means that you are using only a small amount of the credit loaned to you and hence the possibility of paying back the amount is high. In order to keep a decent credit score, ask your bank to either increase the limit of your credit card, or spread out your expenses over several credit cards to avoid reaching the limit on either. You can also pay your credit card dues twice a month so that the limit refreshes each time.

Payment history has a very strong impact on your credit score, so people looking to maintain a proper credit score should pay credit card bills on time. Defaulting on a credit card bill payment will almost certainly lead to difficulty in taking out loans, or opening new bank accounts. On the off-chance that you are able to secure a loan, the interest rates may be very high. Most banks do send you notices when your payment deadline is about to approach. Despite this, the number of credit card defaulters remains astonishingly high.

Having multiple credit cards is neither unheard of nor is it a bad idea. However, managing and keeping track of more than one credit card requires a higher amount of attention. Due dates and the reward points should be noted. A default could result in bad credit score and high interest. Know that inactive credit cards could also negatively affect your credit score, as could applying for multiple credit cards within a given span of time.

While a gap between two loans seems obvious theoretically, a lot of young millennials believe that they need to buy their house and car immediately, resulting in a pool of debt. A loan should ideally be sanctioned for a short period of time. A longer tenure attached to your loan means you end up paying more interest over the years. Try to maintain a minimum gap of 12 months between the end of one loan and the start of the next. This way, financial pressure decreases and ensures that you end up paying the EMIs regularly without any defaults.

Credit basically refers to the act of borrowing money. This could be in any form – credit cards, bank loans or overdrafts. Using different kinds of credit and paying them off properly shows that you are a responsible borrower, and lenders don’t hesitate to lend you credit. In fact, it also helps build your credit score. Regardless of your credit type, it is important to note that you must always pay off your credit on time.

Every time you use a new card, the card comes with a fresh slate for you to build up on credit history. Closing existing accounts shrinks your credit score and makes it difficult for lenders to assess your risk. When your credit history is long and lengthy, it helps lenders asses you more accurately. It also shows that you have been using credit cards for a fairly long period of time and are responsible with the payment, successfully being able to manage it.

It is rare for a mistake to occur on a credit report. However, if it does, it can cause your credit score to plummet. There could be errors on your report suggesting you were 30 days late in your credit card payment, bringing your credit score down, and once the errors are fixed, it can take upto months for your credit score to be rectified. A simpler way is to just avoid any mistakes on your report.

With a monthly salary not sufficing and sustaining you through the month, credit is crucial to pull through the month, whether it is a simple shopping and vacation, or buying a house or car. Your credit can be improved by regularly borrowing small amounts of credit and paying it back in time. However, building up credit does take a lot of time, effort and planning, and hence, a lot of fintech portals have come up with the concept of lending a salary advance which does require an outstanding credit score. Fibe is one such salary advance app which has done away with the importance of the credit score. Instead, it checks many other factors – such as your social worth score in order to determine the interest that will be levied on your instant salary advance.