- Home

- Personal loan

- Eligibility calculator

Online Personal Loan Eligibility Calculator

Learn if you qualify for a credit facility from Fibe. Calculating loan eligibility and the amount you can borrow is made easy with our calculator.

Learn if you qualify for a credit facility from Fibe. Calculating loan eligibility and the amount you can borrow is made easy with our calculator.

This online tool helps you determine how much you can borrow based on several factors, including:

The loan eligibility check process allows you to avoid applying for offers that you are unlikely to be approved for, which can help protect your credit score.

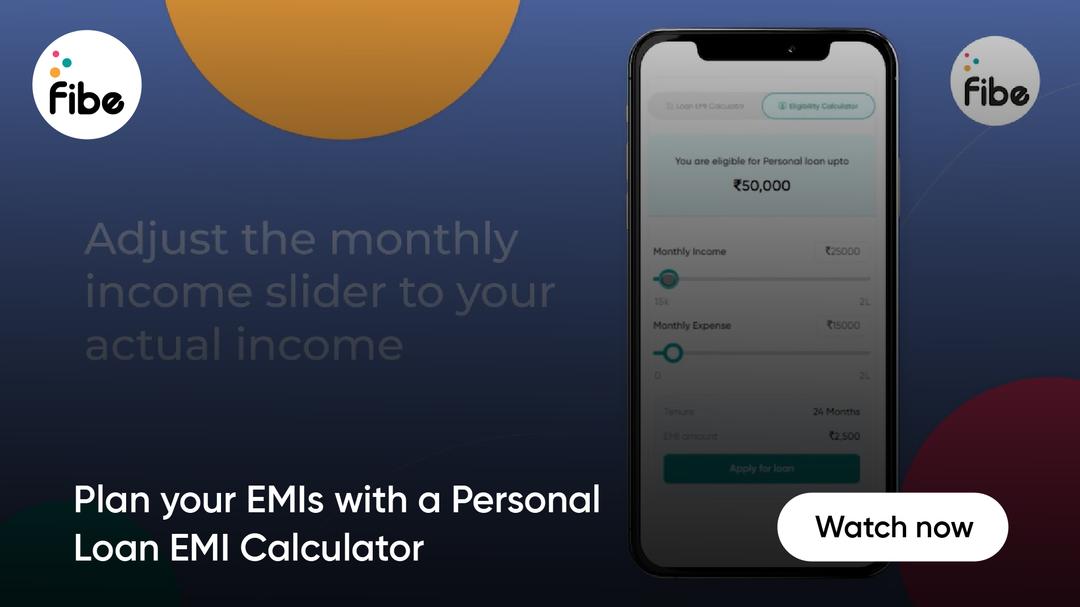

Using this online facility is quite straightforward. Here are the steps to follow when using the personal loan amount eligibility calculator.

This online financial tool makes borrowing simpler and smoother for a borrower. Calculating loan eligibility helps determine how much you can borrow and compare different loan options to find the best rates and terms that work for you.

Your Age

Income

Expenses

Credit score

City pin code

Employment Type

By providing these parameters, you can estimate your loan amount and apply for the right option. It helps you to assess your EMI to help you manage your finances better. This calculator is free and can be used multiple times. If you feel your EMI amount is going high, you can reduce the loan amount and apply for the loan accordingly.

It can be calculated with the help of a personal loan eligibility calculator. You just need to provide some details like age, monthly income, expenses, credit score and city pincode to check your eligibility status instantly.

No, there is no fee or charge to check your loan eligibility. You can use Fibe’s personal loan eligibility calculator online for free.

Below are the factors that determine your loan eligibility:

You can check your loan eligibility with Fibe’s personal loan eligibility calculator. Just select your city, employment type with the combination of age, monthly income, etc. and get the results instantly.

A person can avail of a quick loan only if they are qualifying as per the eligibility criteria. To apply, one:

Your monthly income and expenses play an important role in determining your loan eligibility. It shows how much you can borrow and your repayment ability. At Fibe, you can opt for a loan if your minimum in-hand salary is ₹25,000 per month.

Ever heard of a ‘Money Mule’ scam? It’s when scammers trick people into using their bank accounts to move money for illegal activities — often without them realising it. The Reserve Bank of India (RBI), through its campaign RBI Kehta Hai, wants to make sure you stay informed and protected from such financial traps. What’s …

Continue reading “RBI Kehta Hai: Protect Yourself from Money Mule Scams!”

When it comes to buying a smart TV, price may be one of the first things on your mind. However, you should also look at audio-visual specifications, size, resolution and more before making a final decision. Upgrading to a smart TV is now a must as all the devices are becoming smart in this digital …

Continue reading “How to Own One of the Best Smart TVs in India”

Changing the interior design of your house or maintaining your property can be a big expense. With everyday expenses, saving money for home improvement can take a long time. In this case, a personal loan for interior decoration can help you upgrade your home décor and make it as luxurious as you like without delay. …

Continue reading “Know How To Bring Interior Design Ideas To Life With Personal Loans”

Download he Fibe App the cool new vibe to finance to avail of the loan in just a few clicks from anywhere