- Home

- Blogs

- Instant Cash Loan

- How To Get Instant Loan Without Cibil Score

Loan Without CIBIL Score – Instant Approval & Fast Online Process

Reviewed by: Fibe Research Team

- Updated on: 4 Dec 2025

You can get an instant loan without CIBIL by showing strong income stability, clean bank statements or applying with lenders who use alternative checks. Many digital lenders offer an instant loan online without CIBIL if you meet basic criteria. Fibe allows you to get loan without CIBIL with quick approval.

Getting an instant loan without CIBIL is possible, even if you have never taken a loan before. Many lenders today check your income, bank statements and financial behaviour instead of relying only on your credit score. This makes it easier for first-time borrowers to get a loan without CIBIL score or a long credit history.

Read on to understand how you can improve your chances and apply smartly.

Table of Contents

- What Does ‘Loan Without CIBIL Score’ Really Mean?

- How to Get an Instant Loan Without CIBIL Score?

- Options to Get a Loan Without CIBIL or Credit Score

- Key Risks of Taking a Loan Without CIBIL or Credit Score

- FAQs on Personal Loans Without a Credit Score

- Is it possible to get a loan without credit score and income proof?

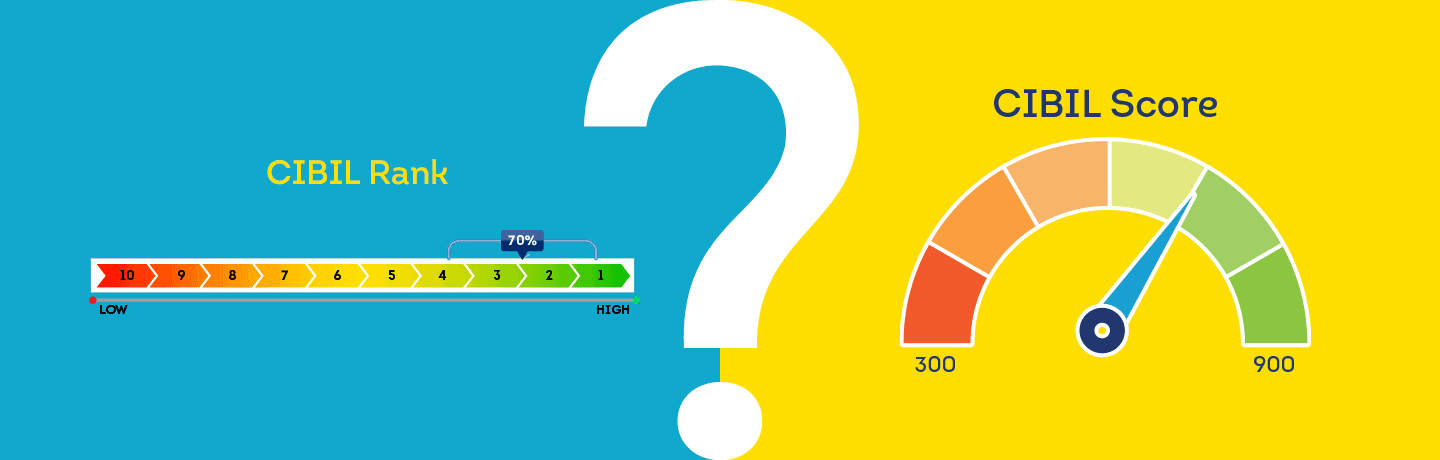

What Does ‘Loan Without CIBIL Score’ Really Mean?

Having no credit score means there isn’t enough borrowing history for lenders to understand how you repay loans. Credit bureaus like CIBIL, Experian, and Equifax label this as ‘No Score’, ‘NA’, or ‘NH’ when you have never taken a loan, never used a credit card, or your past credit activity is too limited.

It does not mean you are a risky borrower. It only means there is no data yet. You can still get a loan without CIBIL score, as lenders look at other factors like your income, bank statements and repayment capacity to decide if you qualify.

How to Get an Instant Loan Without CIBIL Score?

When you apply for an instant loan without CIBIL, lenders look at other ways to understand how reliable you are as a borrower. Here’s what they will usually check and how you can improve your chances:

- Stable income: Lenders want to see that you earn regularly. Salary slips and bank statements help prove that you can repay the loan on time.

- Clean bank behaviour: Regular salary deposits, no cheque bounces and controlled spending patterns make you look financially responsible. It builds trust even without a credit score.

- Lower loan amounts: If you have no score, lenders may approve smaller amounts first. Once you repay on time, your loan limit increases for future borrowing.

- Explain NA/NH status: NA or NH means no credit activity in 24-36 months. You can clarify this to the lender, especially if you recently started earning or have never taken credit before.

- Improving financial discipline: Paying your bills, rent and EMIs on time and avoiding overdrafts shows that you manage money well. This can build trust with lenders even if you don’t have a solid credit score.

Options to Get a Loan Without CIBIL or Credit Score

Here are the easiest ways to get a loan without CIBIL score and income proof:

- Digital NBFCs: These lenders use your income, spending habits and bank statement trends instead of a traditional credit score. Their digital checks are quick, so first-time borrowers can get a loan without credit score more easily.

- Secured loans: Gold loans, loans against FDs or insurance-backed loans are simpler to get because the lender has security. This lowers their risk and helps you apply for an instant loan without CIBIL score and history.

- Peer-to-peer (P2P) lending: P2P platforms connect you directly with individual lenders. Their approval rules are more flexible.

- Co-applicant loans: Adding a partner or family member with a good credit score can strengthen your profile. Lenders feel safer, which increases your approval chance and loan amount.

- Guarantor-backed loans: A guarantor with a strong credit track record acts as an extra layer of assurance. If they qualify, your loan is likely to get approved even if you are new to credit.

Key Risks of Taking a Loan Without CIBIL or Credit Score

Before applying, keep these risks in mind when taking a loan without credit score:

- Higher interest rates because lenders cannot assess past repayment behaviour

- Lower loan amounts since first-time borrowers are treated as higher risk

- Strict income verification as lenders rely more on salary and bank data

- Instant rejection if your bank statements show instability or cheque bounces

Getting an instant loan without CIBIL score is completely possible today. The key is to show stability through your income and bank behaviour. Always look out for lenders that offer loans without strict credit score checks and understand the risks and borrow only what you can repay comfortably.

If you’re looking for reliable leaders, Fibe offers up to ₹5 lakhs as an instant loan even if you are new to credit. You can repay comfortably with a tenure of up to 36 months with no foreclosure charges.

Just download the Fibe instant loan app to get started!

FAQs on Personal Loans Without a Credit Score

Can I get a loan without CIBIL?

Yes. Many lenders offer an instant loan without CIBIL based on income, bank statements and employment stability rather than credit history.

Is it possible to get a loan without credit score and income proof?

This is possible with only secured loans like gold or FD loans. For unsecured loans, lenders will need some income proof or bank data.

What is the minimum eligibility for a loan with no CIBIL score?

You must meet the lender’s basic income criteria and show stable banking behaviour. Each lender has different requirements, but steady income and clean statements can improve your chances in most cases.

Will a loan taken without CIBIL affect my future credit score?

Yes. If you take a loan even with no existing CIBIL score and repay EMIs on time, it helps build your credit history. And if you miss payments or default, that will hurt your credit score like any other loan.