Getting an instant loan without a CIBIL score can be challenging because it is a crucial criterion. Lenders give credit score a high importance because it gives them insights about

- Your credit behaviour

- Your default risk

- Your ability to repay

That said, it isn’t impossible to apply for a loan with low creditworthiness and there are several ways you can try. Can I get a loan without a CIBIL score? Yes, it is possible! Read on to find out how.

What Does ‘No CIBIL Score’ Indicate?

Bureaus offer different ratings for those new to credit or with no borrowing history. In some cases, you may see a ‘No Score’ rating. How to get a personal loan without CIBIL verification? It can mean either of the following:

- You don’t have enough credit history to calculate a credit score

- You haven’t started using any credit and, therefore, have no data for a score

- You have all add-on cards and, therefore, no exposure to credit for a score

In any case, you should build your credit score through responsible credit behaviour. Some tips you can try are:

- Repaying all dues on time

- Keeping a healthy credit mix

- Monitoring your credit utilisation

After building a good score, you can easily get affordable and hassle-free access to loans. However, follow the above tips to maintain and boost your creditworthiness for future borrowings.

Alternatives to Get a Personal Loan Without a CIBIL Score

There are several ways to get an instant loan without a CIBIL score. Some of these are:

- Showcase good repayment capacity by disclosing all income sources

- Opt for secured loans to lower the lender’s risk

- Get a guarantor or co-applicant to ensure complete repayment

- Apply with lenders like Fibe, who offer borrowers an instant loan without credit score requirements

Eligibility Criteria for Personal Loans Without a Credit Score

As mentioned, Fibe offers a personal loan without CIBIL check or credit score requirements, provided you meet the basic eligibility criteria. Can I get a loan without a CIBIL score? Yes, if you meet the following conditions:

- You should be between the ages of 21 and 55

- You should be a citizen of India

- You should have a minimum income of ₹15,000 if residing in non-metro cities or ₹18,000 if residing in metro cities

- You should have the necessary KYC documents, such as ID and income proof

Documents Required for Personal Loans Without a Credit Score

With Fibe, you only need to upload these documents to get an instant loan without a CIBIL check or credit score:

- Address proof (utility bills, passport, rental agreement, voter ID)

- Identity proof (PAN card, Aadhaar card, passport, driver’s license)

- Income proof (bank statements for 3-6 months and salary slips)

- Photo identification

Expert Tips and Advice for Getting a Loan Without a CIBIL Score

Here are some expert tips and advice to help you to get a loan without CIBIL check:

- Understand Your Financial Position:

- Understand your current financial position regarding income, expenses and savings.

- Create a budget to manage your finances properly and let you have the wherewithal to repay a loan taken.

- Consider Alternative Credit Scoring Models:

- Some lenders use alternative credit models that draw from other constituents while assessing creditworthiness apart from the traditional credit score.

- Research and talk to lenders using such modes as it might increase your chances of getting a loan.

- Maintain a Good Relationship with Your Bank:

- This factor will have a powerful influence if you have a healthy relationship with your bank.

- Use services from your bank very often, maintain a healthy account balance, and keep your account away from overdrafts.

- Opt for Peer-to-Peer Lending:

- Peer-to-peer loans are where your loan is not from a bank but from other individuals online.

- Such sites have laxer inclusionary criteria than your regular banks.

- Leverage Your Assets:

- If you have a property or an investment, secure and leverage it for your loan.

- Secured loans usually carry less interest and are easier to procure without a CIBIL score.

- Negotiate with Lenders:

- You should not hesitate to argue with the lenders about terms and conditions.

- Make them pay attention to your repayment capability and strength so they may understand your conditions better.

- Stay Informed:

- They say to keep updated with all the current financial products and service innovations.

- Attend financial literacy workshops or speak to a financial advisor for individualised advice.

Steps to Get Personal Loans Without a Credit Score

Follow the steps below on the Fibe website or app to get an instant loan without a credit score in minutes. How to get a personal loan without CIBIL verification? Follow these simple steps:

- Register with your mobile number

- Enter your basic details

- Check your approved limit

- Upload your KYC documents

- Choose the amount and tenure you want

Fibe offers up to ₹5 lakhs as an instant loan without CIBIL score requirements at interest rates starting from just 2% a month. You can use the funds with no end-use restrictions and repay comfortably with a tenure of up to 36 months with no foreclosure charges. Download the Fibe instant loan app for loans without CIBIL score criteria.

FAQs on Personal Loans Without a Credit Score

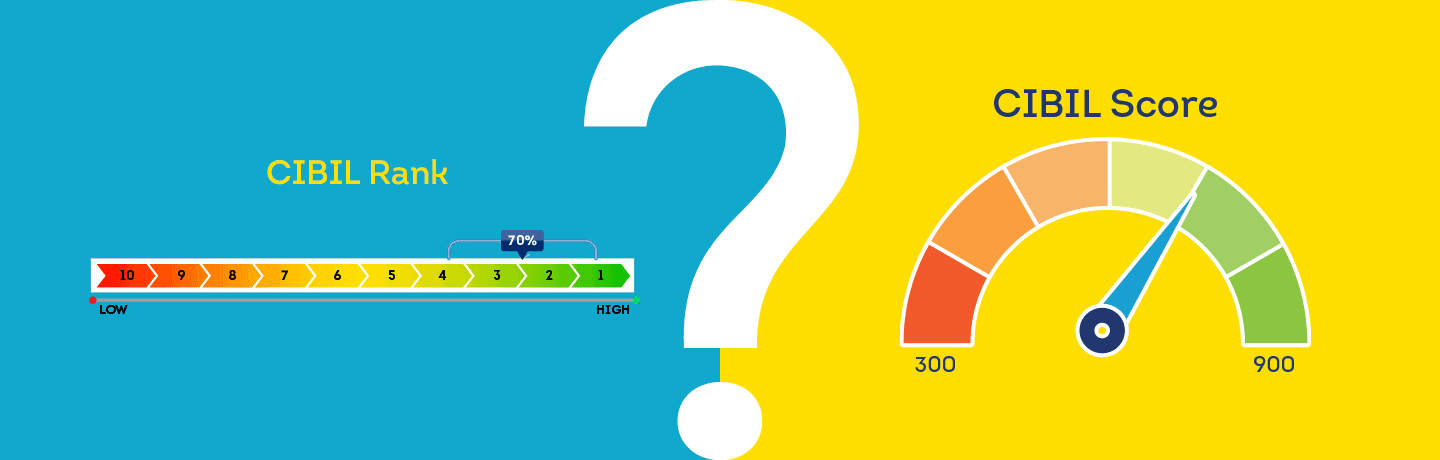

What is meant by the CIBIL score?

It is the 3-digit credit score assigned by TransUnion CIBIL and depends on multiple factors, such as:

- Repayment track record

- Credit utilisation

- Credit mix

- Number of enquiries

What is a good CIBIL score?

A score above 750 is generally ideal for affordable and easy financing.

How can I get a loan fast without a CIBIL score?

Apply with Fibe to get a personal loan in a matter of minutes. All you have to do is follow these steps:

- Register on the app or website

- Fill in a few basic details

- Upload the required documents

Which app is best for a loan without a CIBIL check?

Fibe’s instant loan app is a leading app that allows you to get quick and affordable funding. Here are the easy steps you need to follow:

- Download the app

- Fill in some basic information

- Upload the KYC documents for approval

What can I do if I have no CIBIL score?

Apply with Fibe to get an instant loan without a CIBIL score. We use an alternate scoring mechanism and, thus, offer loans even to those with a low or no credit score.