- Home

- Blogs

- Bank Statements

- Steps To Get Your Bank Account Statement

Steps to get your bank account statement

Reviewed by: Fibe Research Team

- Updated on: 13 May 2025

Reviewed by: Fibe Research Team

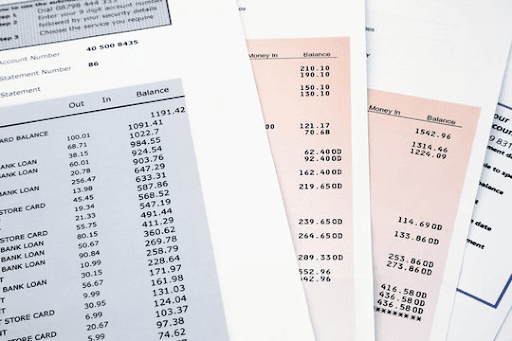

A bank statement, also known as an account statement, is a document issued by a bank. This document provide details of your banking transactions in savings or current account for a specific period. It also helps you keep track of your transactions and accounts on a daily basis.

With a bank statement, you can quickly check your current account standing, any suspicious activity and if there are any errors listed. In addition, reviewing the banking transactions regularly helps you track your spending habits and notice patterns for better budgeting.

Furthermore, bank statements are required as a mandatory document when applying for any loan. This helps the lender understand your financial profile and whether you have a regular income source or not. In some cases, it can also dictate your financial habits, and with the bank statement, the lending institution assesses your repayment capabilities. Before knowing how to get a bank statement, you must understand what is included in a statement.

Here are a few details of what you get on a bank statement online:

There are two modes of getting your bank statement — offline and online. If you opt for the offline mode, you have to visit the branch personally and submit a requisition letter to get the statement.

You may receive the statement immediately in hand or by post to your registered address. However, to easily check your statement at any given time, you can choose the online option. To know how to get an online bank statement, read on.

There are several ways to obtain a bank account statement:

The simplest answer to the question, ‘how can I get my bank statement online?’ is to use your bank’s mobile app. If you don’t have the app or would prefer not to use it, you can sign in through netbanking on website. Both allow you to access your bank statement online.

Let’s understand the general guide to access the information.

Receive the account statement in your mail as an encrypted PDF or get the option to directly download the PDF

It helps to know how to take a bank statement online in more ways than just one. Your other option is to check your registered email. Banks often send regular summaries of your account or even a consolidated statement every month. Here is the process to check it.

Knowing how to get an online bank statement through the ATM is important because it is very simple and can be done by anyone.

Below are the steps:

Follow these simple steps to check your bank statement online:

You can alert the respective financial institution if you notice any error or discrepancies in your bank statement. Now that you know how to get an online bank statement, check it regularly to ensure that your finances are accurate. Apart from tracking your expenses, you may need to submit your bank statement when applying for a visa.

Most banks now provide online bank statements, making it easier for you. However, note that banks maintain a limit of 7 years to retain your bank transaction statements. So, you should file these statements either physically or digitally.

Here are a few direct links to obtain a PDF account statement from popular banks:

| Canara Bank Net Banking | State Bank of India | HDFC Bank |

|---|---|---|

| Axis Bank | ICICI Bank Personal Banking | Bank of Baroda Net Banking |

| PNB Bank | Bandhan Bank | HSBC Online Banking |

| Indian Bank | Central Bank | Union Bank e-statement |

Bank statements provide a clear overview of your financial activity. Not only does it help monitor your spending but it enables you to be mindful about your finances. This way, you can reach your planned financial goals.

If you are planning to avail of a personal loan at affordable interest rates, Fibe is the solution for all your financial requirements. With minimal documentation and quick approval, you can apply online at Fibe!