- Home

- Blogs

- Instant Cash Loan

- How Instant Loans Can Boost Your Credit Score

How Instant Loans Can Boost your Credit Score

Reviewed by: Fibe Research Team

- Updated on: 4 Mar 2025

Reviewed by: Fibe Research Team

In today’s debt-driven economy, all individuals and business ventures depend on credit at one point or another. The credit score becomes essential in this context as it establishes the borrower’s creditworthiness and repayment history.

Lenders are more likely to offer a loan or a credit card if your score is high. As such, you must strive to improve your credit score to get a loan at affordable rates and keep your borrowing costs low. While improving your credit score is not quick or simple, it’s not impossible either.

To know about how instant loans can help boost your credit score, read on.

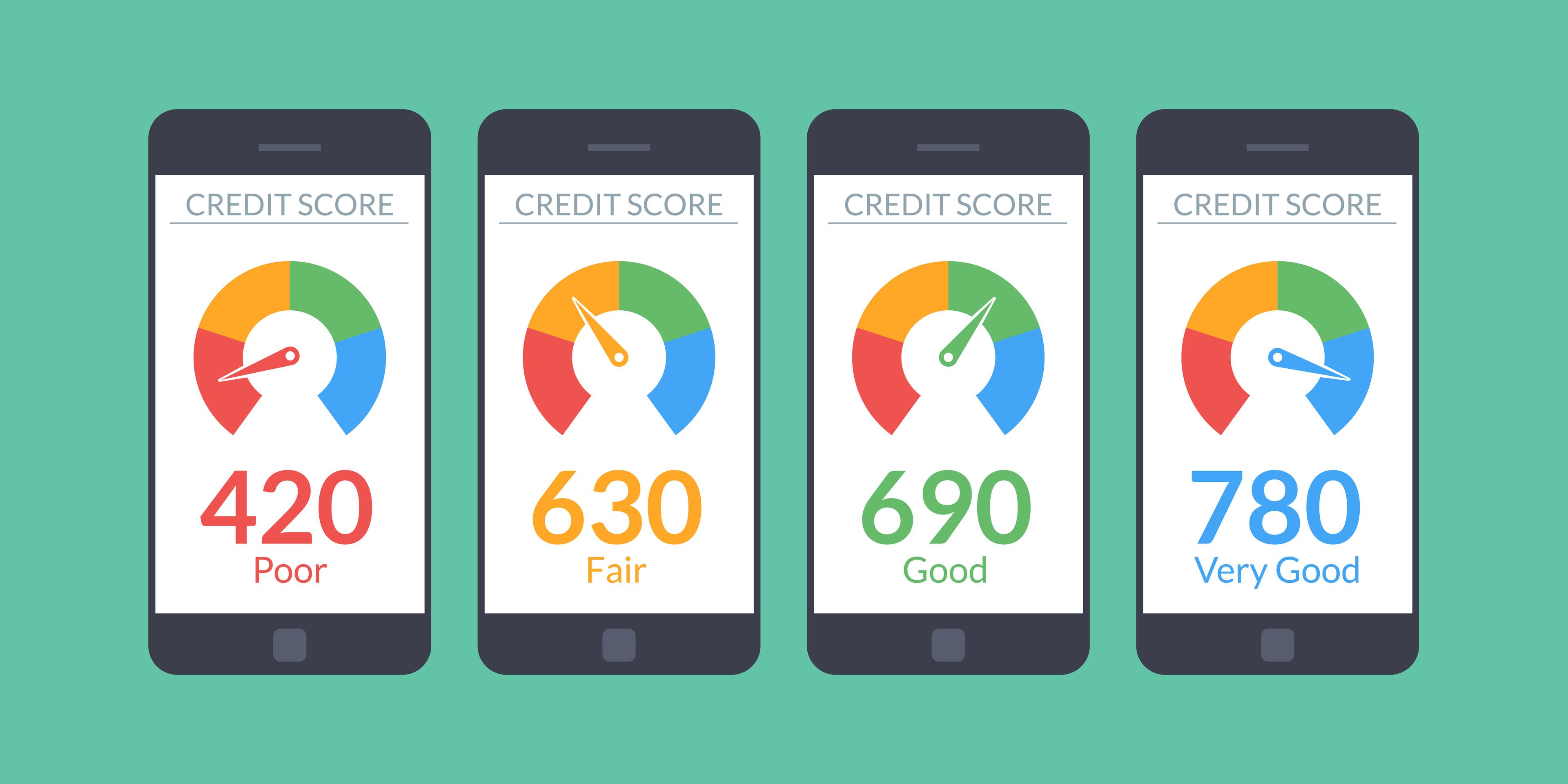

A credit score is a three-digit score that helps financial organisations determine how likely you are to repay debt. It depends on your credit history – a record of your ability and willingness to repay debts. Your credit history also includes information regarding defaults and existing debt.

Credit scores usually range from 300 to 900. Lenders generally provide loans if your credit score is over 700. However, they may not even consider your loan application if it is below 650. As such, you need to have a credit score of 700 or above to get affordable loans and credit.

There are three main credit bureaus in charge of creating your credit reports and scores. For this, bureaus use the data sent by the financial institutions. The data generally includes:

Different bureaus have different methods of determining your credit score based on the above information. Hence, there can be slight variations in your credit score assigned by different bureaus. These companies generally update your credit score every month and not in real time.

While it may seem paradoxical, getting a loan can help improve your credit score in the long run. This is because a credit score is the reflection of your ability to repay a loan. So, if you handle the repayment of an instant loan in a disciplined manner, you can boost your credit score.

Here is a glimpse into how an instant cash loan can help boost your credit score:

To improve your credit score, you can choose a loan from Fibe. We offer Instant Personal Loans of up to ₹5 lacs with a quick sanction and a simple application process. That’s not all. Fibe does not rely only on credit scores completely to determine your eligibility. We have a proprietary alternate credit scoring model that enables us to offer loans to individuals who are new to credit.

Download the Fibe Personal Loan App or register on the website to apply for a loan and start building your credit score!

A credit score reflects your ability to repay a loan. So, if you repay your EMIs on time, your score will improve gradually.

Yes, timely repayment and a low credit utilisation ratio can help boost your credit score.

You can improve your credit score with an instant loan by repaying the dues on time and keeping your credit utilisation ratio low.

References:

https://www.sc.com/in/stories/personalloan-boost-credit-score-pl/