Based on your loan history (of all kinds), a credit score is a number that measures and rates your financial health. To decide whether to accept someone for a loan or credit card and to determine what interest rate to charge, lenders use credit scores.

In order to decide whether to rent your house, give you a job, or how much to charge you for car insurance, other businesses may also use your credit score.

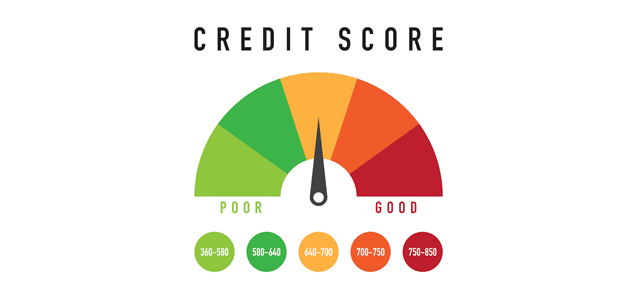

The credit score ranges between approximately 300 and 850. “Good” scores are considered in the range of 600. When you have a higher score, you have a greater chance of being accepted for loans in more favorable conditions. You can visit the EarlySalary Free Credit Score check to get an idea of your credit scores. The free credit score facility is also part of the EarlySalary Credit Suite – a complete offering for aspiring Indian professionals, featuring Instant loans, a Salary Card, and much more!

There are two types of credit scores – generic & custom scores:

When they give somebody money, there is one main question that lenders have in their minds: “Will I get it back?”

The following factors are taken into account in this portion of your score:

For each account on your credit report, have you paid your bills on time? Paying late has a detrimental impact on your ranking.

How late were you—30 days, 60 days, or 90 + days if you paid late? The later you are, the worse your score is.

Have some of your collection accounts been sent to you? To potential lenders, this is a red flag that you could not pay them back.

This second-most critical portion discusses the following considerations:

How much would you intend to give on those forms of accounts, such as mortgages, car loans, credit cards, and payment accounts?

How much do you owe in total and how much do you owe in installment accounts as opposed to the original amount?

How much did you use your total usable credit? Nothing is better, but owing a little can be better than owning none at all. That way, lenders get to see that you are accountable and financially secure enough to pay it back if you borrow money.

Although your credit score is important for getting accepted for loans and getting the best rate of interest, to get the kind of score that lenders want to see, you don’t need to stress about the scoring criteria. With credit solutions like Fibe that offer more than just instant loans, there may not be any reason for you to consider a traditional lender. Fibe’s Credit Suite is a revolutionary new all-in-one package for aspirational Indians of this next decade. With a free credit score facility available instantly, there’s also:

Sure, your score will shine if you handle your credit wisely. But your finances can shine without a credit score too!

Feel free to get in touch with us for any questions on credit, loans, and your instant cash needs!

Download the personal loan app here, or simply log in to our website and be a part of the #OneSmallStep experience.