- Home

- Blogs

- Personal Loan

- How To Use Personal Loans To Build Your Credit Score

How Personal Loans Can Build Your Credit Score Quickly

- Updated on: 1 Aug 2024

Credit scores have a significant impact on how swiftly you can access credit. You can use the loan to build a healthy credit score, which makes you eligible for quick and budget-friendly loans.

Here’s a deeper look into how a personal loan affects your score and how you can use it to build your credit score.

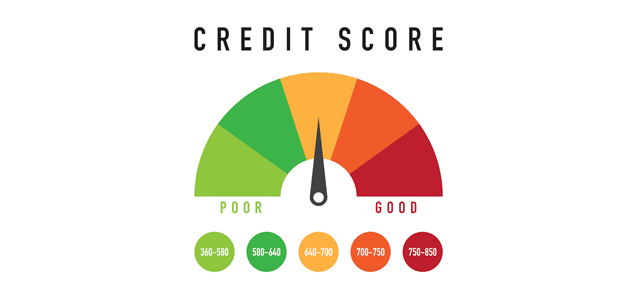

Your credit score generally ranges between 300 and 900 and represents your creditworthiness. Since personal loans are an unsecured type of loan, lenders rely on this score to review your application and repayment ability.

Credit bureaus calculate the score based on the credit behaviour information received by financial institutions. The bureaus check your repayment history, utilisation ratio, credit length and types of credit, among other details.

Given this, getting a personal loan can improve or lower your credit score. The key is to pay your EMIs on time. If you do that, you can successfully improve your score in over time. This makes it an excellent option to build a credible score.

With a smart strategy and timely repayments, every type of credit can help build a positive credit history. Here are two types of loans that you can use to build your score:

You can also build your credit score through a credit-building loan. This is essentially a loan for which you make fixed payments, like EMIs. However, you get your funding only after you’ve paid everything along with the interest.

This way, you showcase responsible repayment behaviour and have access to a substantial amount at the end of the tenure. So, in a way, it works like a savings account, where you deposit a sum every month and receive the accumulated corpus at the end, while building your credit score.

Having too many loans can make your repayment challenging as you will have to keep track of multiple EMIs. In such cases, you can use a quick personal loan to consolidate your existing debts and build your credit score.

Consolidating your debts allows you to pay them off at once and switch to a single repayment channel. This can also help you save considerably because lenders like Fibe offer lower interest rates on personal loans compared to credit cards and other types of loans.

An easy and effective way online personal loans help build your credit score is by helping you create a strong repayment track record. This reflects positively on your credit score calculation. All you need to do is pay off your EMIs on time and within the deadline.

An important point to note here is to borrow from lenders that offer credit to those who are new to credit or have a low score. This is where you can rely on Fibe, as we have an alternate credit scoring model. This allows us to offer loans to individuals who don’t have the ideal score or are new to credit.

Here are some factors you should keep in mind if you’re using online personal loans to build your credit score.

If you’re taking out an online personal loan, ensure you only take one at a time. You must limit the number of loans you take in a fixed duration to as minimum as possible.

This is because having multiple applications can imply you are credit-hungry, which makes you a risky borrower and the lender becomes hesitant to approve your application.

Additionally, choose loan providers offering low-interest rates and easy repayment plans to ensure you can repay without any stress.

You must keep an eye on the amount of debt you are taking when you get personal loans to build your credit score. Avoid opting for excess funds to ensure that you can meet the repayment requirements.

Always try to maintain a healthy mix between secured and unsecured borrowings. You should also aim to your debt-to-income ratio under 40%, to ensure you can manage repayments.

Finally, decide the personal loan amount wisely and don’t apply for an unreasonably high amount. Remember that you have to repay it and it should fit within your budget for it to reflect positively on your credit history and score.

If you take out a quick personal loan that’s too high, repayments can be tough and stressful. Hence, plan out your loan amount wisely to ensure that you don’t run into any roadblocks while building your credit score.

Now that you know how credit scores and personal loans are interlinked, you can make responsible borrowing decisions to improve your credit score. Remember, building your credit score takes time and consistent effort.

However, with the Fibe Instant Cash Loan, you can get up to ₹5 lakhs even if you don’t have a high credit score as we use an alternative credit score mechanism. We also have minimal requirements and pocket-friendly rates, making us one of India’s leading online personal loan-providing platforms.

Download the Personal Loan App or go to our website to apply in minutes!

Yes. As personal loans don’t require you to provide collateral, lenders see your credit score as an indication of your repayment ability.

Yes, if you default on your personal loan EMIs, the credit score takes a direct hit.

Yes, a personal loan can help you build a credit score, provided you repay it on time.

Yes, taking a personal loan and repaying it on time will allow you to build credit over time.