- Home

- Blogs

The Vibe Journal: Finance Blogs

From tax-saving tips, ways to manage your loan to personal finance — this is the ultimate finance blog for all your queries.

With the best books for human resource management, you get the roadmap to the journey of financial wellness. Receiving financial guidance as employee benefits is more important than ever for employees seeking to improve their financial well-being and achieve short- and long-term financial objectives. Financial wellness is a term that refers to a person’s overall …

Continue reading “5 HRM Books Every HR Should Read To Ensure Financial Wellness To Employees”

The pandemic brought along with itself lockdowns and quarantines. All the hopes and desires of going to restaurants and trying different things to eat went down the drain. But humankind has always found ways to fight against adversity by innovating. The Internet came to their rescue and everyone tried to be chefs at their own …

Continue reading “A Few Must-Have Kitchen Appliances For Lockdown Chefs”

With the rise in remote and hybrid working, there has been a rise in the culture of corporate outings in Bangalore. Numerous companies in and around the Silicon Valley of India allow you to enjoy a vacation without compromising your work, giving birth to an idea of workation (work + vacation). These places have scenic …

Continue reading “8 Best Places near Bangalore for a Workation”

Times are extremely tough now, especially with the worldwide turmoil created by the Covid-19 pandemic. Fibe hopes that you and your loved ones are healthy, safe, and taking precautions. We are well aware of the problems our team members, friends, and family are facing and we deeply care about the impact the pandemic has caused …

Continue reading “EarlySalary announces CarES campaign in its fight against COVID-19”

National Doctors Day is here! It is celebrated in India on July 1 to recognize and honor the contributions and sacrifices made by our physicians. At EarlySalary, we’re taking this opportunity to thank doctors for all that they do. Let’s revisit their lives over the past year. The coronavirus pandemic has been tough on all …

Continue reading “This Doctors Day Let’s Salute Our Saviours”

Financial stress can have a hard-hitting impact on an individual’s personal and professional life. A recent Ernst & Young study shows that around 81% of Indian employees experience a financial shortfall between two consecutive pay cycles. A lack of financial literacy can force many to opt for loans at high interest rates. Many individuals go …

Continue reading “Benefits of Financial Wellness for Employees”

Financial influencers in India and abroad share their expertise freely and abundantly via blogs, Instagram, Twitter and more. These influencers’ voices are heard by millions of people and have helped in changing many lives as well. Take Shark Tank, for example; the show and investors helped save and grow businesses and made many rethink the way …

Continue reading “Best Personal Finance Influencers You Should Follow in 2024”

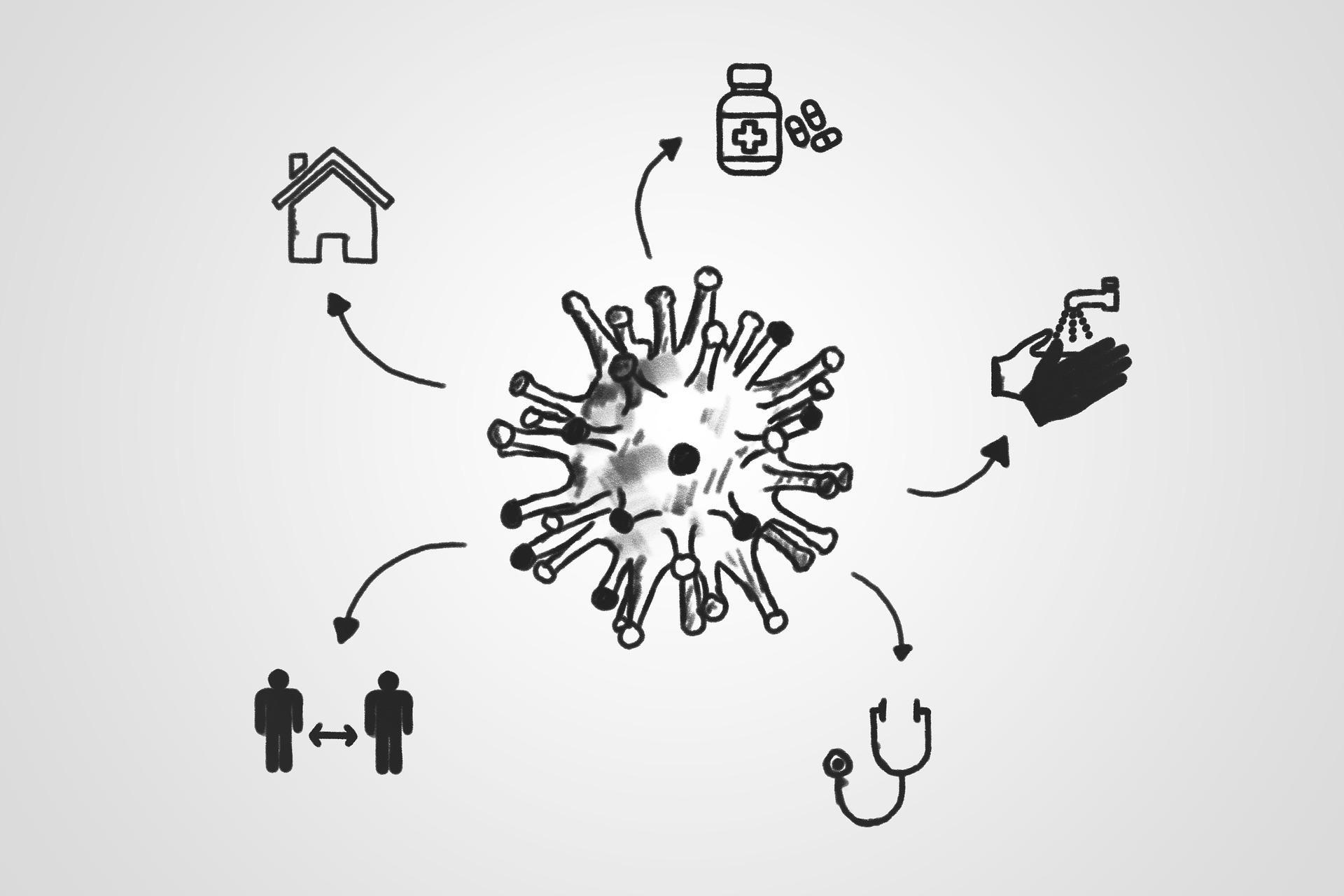

You must’ve heard it before; prevention is better than cure. And prevention is especially needed for our fight against Covid-19. When the second wave hit this year, many states in India suffered tremendously and still are. India’s healthcare system has tried tirelessly to save lives; however, India dealt with the shortage of oxygen and the …

Like physical wellness, financial wellness should occupy a central place in our list of life goals. Unlike physical wellness though, it is often ignored or taken casually by people. According to research, with 69% of workers being stressed about their finances and 72% worrying about their finances at work, it’s not hard to see why …

Continue reading “Financial Wellness: Why Should You Care About It?”

HR’s passion for employee welfare and finance’s love for financial metrics in an organisation aren’t two distinct functions operating in different universes. The two departments co-exist and function together along with sales, production, marketing and other departments. While HR is tasked with hiring and training the production force, it requires digesting quite a lot of …

Continue reading “How Important is it for HR to Understand Finance?”