Have you ever found yourself in situations where juggling between the many expenditures, investments, and savings just seems impossible? It often happens that in our busy everyday lives, we may not have a sense of how much we are spending. But for some of us, it is only when we run into financial troubles like …

Continue reading “Here’s How To Find The Right Balance Between Saving, Investing, and Spending”

In essence, the term young professional commonly refers to people in their 20s-30s working in any profession or a white-collar occupation. It is a general notion that young professionals who have just started their professional life usually face a lot of challenges in terms of managing their personal finance. There are essentially two reasons for this: One, …

Continue reading “5 Personal Finance Mistakes Young Professionals Make”

The best gift to your children on this children’s day could be inspiring a quest to achieve financial interdependence by imparting the knowledge of savings and investments. Kids pick habits of their parents, be it their shopping custom or any financial activity they do. Teaching the children the art of saving is one of the …

Continue reading “This Children’s Day, Gift Your Child the Habit of Saving”

Looking for ways to enjoy Diwali without overspending? Then this space is for you. The festival season often comes with gift shopping, home décor, family bonuses and endless celebrations. All of which can make your budget spiral out of control. Here’s a guide that will show you how to: Let’s dive in! Step 1: Create …

Continue reading “Celebrate Big with Budget-Friendly Diwali Shopping”

The festive season is finally here and with it have arrived some of the best deals, discounts, and cashback offers. E-commerce giants such as Amazon and Flipkart are gearing up for massive sales. Electronic gadgets such as phones, laptops, and cameras have been amongst the best sellers during the recently concluded shopping sales on e-commerce …

Continue reading “The Best Deals on All iPhones This Shopping Season”

Besides the fact that taxes are often perceived as a financial burden, a lack of awareness about financial planning only adds more to the stress. A majority of taxpayers fail to fit the tax-saving piece into their financial puzzle. Maybe it’s time to teach students taxes when they’re still in school to train them for …

Stress is a universal issue, impacting professionals across sectors, designations, and organizations. It severely deteriorates an employee’s work performance and comes in different forms and shapes. Take financial stress – featuring challenges in meeting loan EMIs, or managing the usual daily bills at times. As any leader may guess, this can be a huge detriment …

Continue reading “How financial stress impacts job performance”

The festive season is finally here, and it brings with it much-awaited shopping sales. With the global pandemic, there has certainly been a slump in the economy as people have put off making big purchases. But as the economy restarts again, e-commerce giants like Flipkart and Amazon have geared up for major shopping sales. Let’s …

Continue reading “The best ways to save on big purchases this shopping sale”

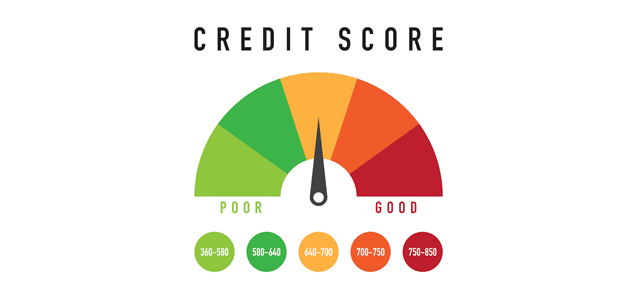

Based on your loan history (of all kinds), a credit score is a number that measures and rates your financial health. To decide whether to accept someone for a loan or credit card and to determine what interest rate to charge, lenders use credit scores. In order to decide whether to rent your house, give …

Continue reading “Know what your credit score says about you”

Over the years, an individual’s or even an organisation’s creditworthiness has come to be defined by their credit score. A loanee’s traditional data (e.g. credit history, types of credit, credit utilisation, etc.) is usually the only factor considered by credit scoring systems to evaluate their creditworthiness. The problem with this system is that a significant …

Continue reading “Alternative Data Is Now Mainstream in Credit Risk Analysis”