- Home

- Personal loan

- Eligibility calculator

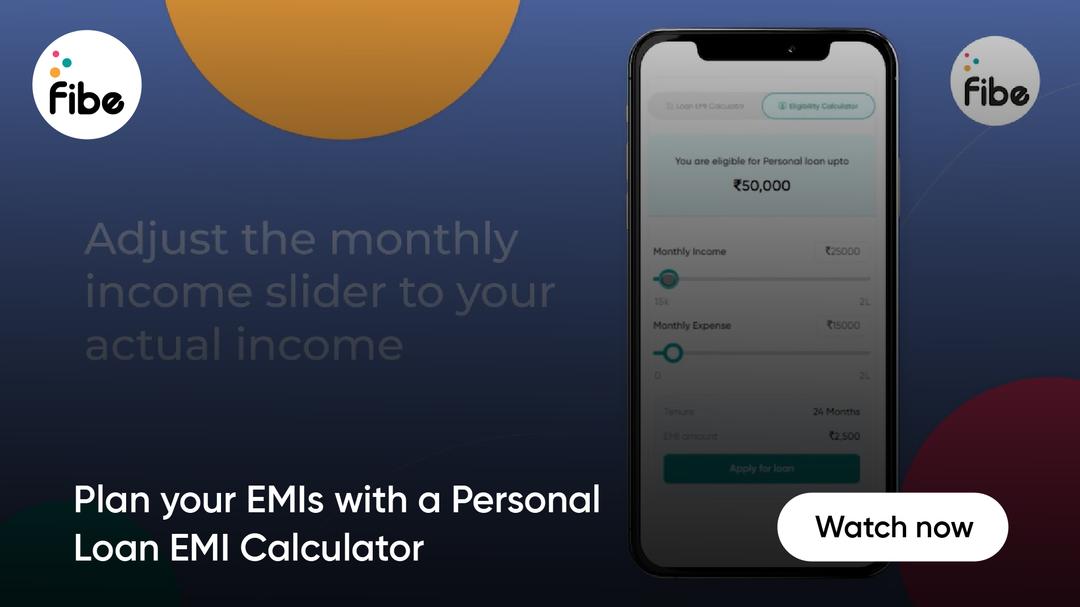

Online Personal Loan Eligibility Calculator

Learn if you qualify for a credit facility from Fibe. Calculating loan eligibility and the amount you can borrow is made easy with our calculator.

Loan Eligibility Calculator

This online tool helps you determine how much you can borrow based on several factors, including:

- Your Income

- Credit Score

- Employment Status

The loan eligibility check process allows you to avoid applying for offers that you are unlikely to be approved for, which can help protect your credit score.

How to use the Personal Loan Eligibility Calculator?

Using this online facility is quite straightforward. Here are the steps to follow when using the personal loan amount eligibility calculator.

- Enter your income, monthly expenses and credit score

- Add other relevant information

- This loan eligibility check process shows you how much you can borrow based on the lender's eligibility criteria

Why is Using Fibe’s Loan Eligibility Calculator Beneficial?

This online financial tool makes borrowing simpler and smoother for a borrower. Calculating loan eligibility helps determine how much you can borrow and compare different loan options to find the best rates and terms that work for you.

Your Age

Income

Expenses

Credit score

City pin code

Employment Type

By providing these parameters, you can estimate your loan amount and apply for the right option. It helps you to assess your EMI to help you manage your finances better. This calculator is free and can be used multiple times. If you feel your EMI amount is going high, you can reduce the loan amount and apply for the loan accordingly.

FAQs on Personal Loan Eligibility Calculator

It can be calculated with the help of a personal loan eligibility calculator. You just need to provide some details like age, monthly income, expenses, credit score and city pincode to check your eligibility status instantly.

No, there is no fee or charge to check your loan eligibility. You can use Fibe’s personal loan eligibility calculator online for free.

Below are the factors that determine your loan eligibility:

- Age

- Monthly Income & expenses

- Employment Type

- City/Country you reside

- Credit Score

You can check your loan eligibility with Fibe’s personal loan eligibility calculator. Just select your city, employment type with the combination of age, monthly income, etc. and get the results instantly.

A person can avail of a quick loan only if they are qualifying as per the eligibility criteria. To apply, one:

- must be between the age of 19 and 55 years

- must be a salaried individual with a minimum in-hand salary of ₹25,000 per month

- must be a resident of India

Your monthly income and expenses play an important role in determining your loan eligibility. It shows how much you can borrow and your repayment ability. At Fibe, you can opt for a loan if your minimum in-hand salary is ₹25,000 per month.

Eligibility calculator Blogs

Getting a loan used to mean long forms, long queues and waiting for weeks. That’s not the case anymore. Now, you can apply, get approved and receive money in minutes – all through your phone. But here’s the big question: which one is better between an app-based loan vs traditional loan? Now, both these options …

Continue reading “App-Based Loan vs Traditional Loan: Which One Works Better for You?”

If you already have a personal loan and want to cut your EMIs or borrow more, you have 2 smart choices – a balance transfer or a top-up loan. Both help you manage your loan better but serve different goals. A balance transfer moves your loan to another lender with a lower rate. A top-up …

Continue reading “How to Borrow Smart With Balance Transfer and Top-Up Loans?”

A wedding is one of the happiest milestones in life. And like every big goal, it needs some financial planning. If you’re a salaried professional, starting early can really help. Setting a budget, saving a little each month or exploring loan options keeps you ready when the big day arrives. If you’re wondering how salaried …

Continue reading “Smart Ways to Finance a Wedding as a Salaried Professional”

The cool new vibe to finance

Download he Fibe App the cool new vibe to finance to avail of the loan in just a few clicks from anywhere