With the business world being taken up by a storm of young professionals, it is an obvious corollary that their personal needs and aspirations are on the rise as well. In today’s time, more and more people are resorting to taking personal loans to fulfil their short term and long term needs and aspiration: be …

Continue reading “A Quick Guide on Personal Loans for Salaried Employees”

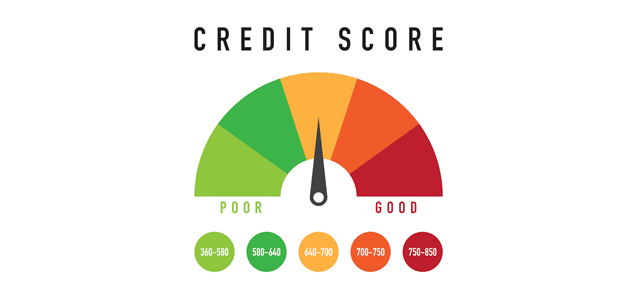

Credit scores have a significant impact on how swiftly you can access credit. You can use the loan to build a healthy credit score, which makes you eligible for quick and budget-friendly loans. Here’s a deeper look into how a personal loan affects your score and how you can use it to build your credit score. How …

Continue reading “How Personal Loans Can Build Your Credit Score Quickly”

In the recent past, the way we deal with finances has gone under major overhauling, especially in India. A considerable portion of that can be attributed to the continuous change in the FinTech sector specifically. Be it the increasing popularity of NBFCs, virtual banking, or new and innovative financial services being available remotely with next …

Continue reading “Indians, it’s time we considered a credit suite”

Your wedding is probably one of the most memorable days of your life, but it doesn’t have to be the most expensive one. The hard work, time, and money put into the process of wedding planning are unparalleled. From liaising with various vendors to inviting the guests, to keeping track of the budget range, which …

Continue reading “Ultimate Hacks To Manage Wedding Finances”

Both businesses and individuals often require credit. And this need has traditionally been fulfilled by banks (and their overdraft facilities) and large, established institutions. But thanks to advancements in several areas – technology, a rising startup ecosystem, and even market demand, short-term credit via loan apps have gained much popularity in addition to traditional methods …

If you have a low CIBIL score and are worried about getting a loan, the good news is – yes, you can still get a personal loan even with a low score. Many people search for personal loan for low CIBIL score or wonder how to get personal loan with low CIBIL score because they …

Continue reading “Personal Loan for Low CIBIL Score – Quick Approval Options”

Wedding season is around the corner, and no one does weddings better than we Indians do with the whole “big fat Indian wedding” – a larger than life setup, designer outfits, extensive guest list, and a never-ending food menu. Since weddings are arguably one of the most memorable days for the bride and the groom …

Continue reading “Fulfill Your Wedding Dream With Fibe’s Wedding Loan”

With online personal loan applications, you can receive quick credit with minimal paperwork. The interest rates you get differ depending on various factors like your credit score and the lender. Some lenders also provide salaried individuals with personal loans pre-approved up to a certain amount. All such loans, though, can be categorised into short-term personal …

Continue reading “Long Term Or Short Term Loans: Which should you choose?”

With technology advancing rapidly with every passing day, the way that you access financial services is changing too. In fact, access to loans and other financial services is now possible from the comfort of home. This extends to helpful tools like the EMI calculator. One of the biggest advantages of an EMI calculator is that …

Continue reading “The Biggest Advantages of Using an EMI Calculator Before Your Personal Loan”

When applying for a personal loan, one of the biggest concerns borrowers have is understanding all the costs involved. What is the processing fee for personal loan? Are there any personal loan hidden charges that might surprise you later? Getting clarity on these questions helps you plan your finances better and repay without stress. Being …

Continue reading “Personal Loan Hidden Fees and How to Avoid Them”