If you are looking at growing your money, the world of investments has no limits. While there are conventional methods of investment like fixed deposits, PFs, bonds and more, there are multiple alternative methods you may want to explore too. Non-traditional methods can surprise you and provide outsized results. Here are a few different types …

Continue reading “What are some non traditional ways to invest and grow your money?”

It is believed that living well and achieving dreams like buying a car, travelling or buying a home require quite a bit of financing as well as financial planning. Saving a bit of your income each month goes a long way if you wish to lead a comfortable life and be prepared for emergencies like …

Just landed a new job and struggling to meet ends? Don’t know who to turn to for your temporary cash-crunch? A salary advance can be a panacea for all your liquidity problems. The concept technically refers to an early payment of a portion of an employee’s salary – but is often used to refer to …

From paid vacations to health insurance, organisations have left no stone unturned to ensure the convenience of their employees. However, with the state of the global economy and rate of inflation we tend to see, money seems to be slipping out of our bank accounts faster than we can earn it. Despite meticulous planning and …

Continue reading “Understanding Salary Advance and How to Manage It”

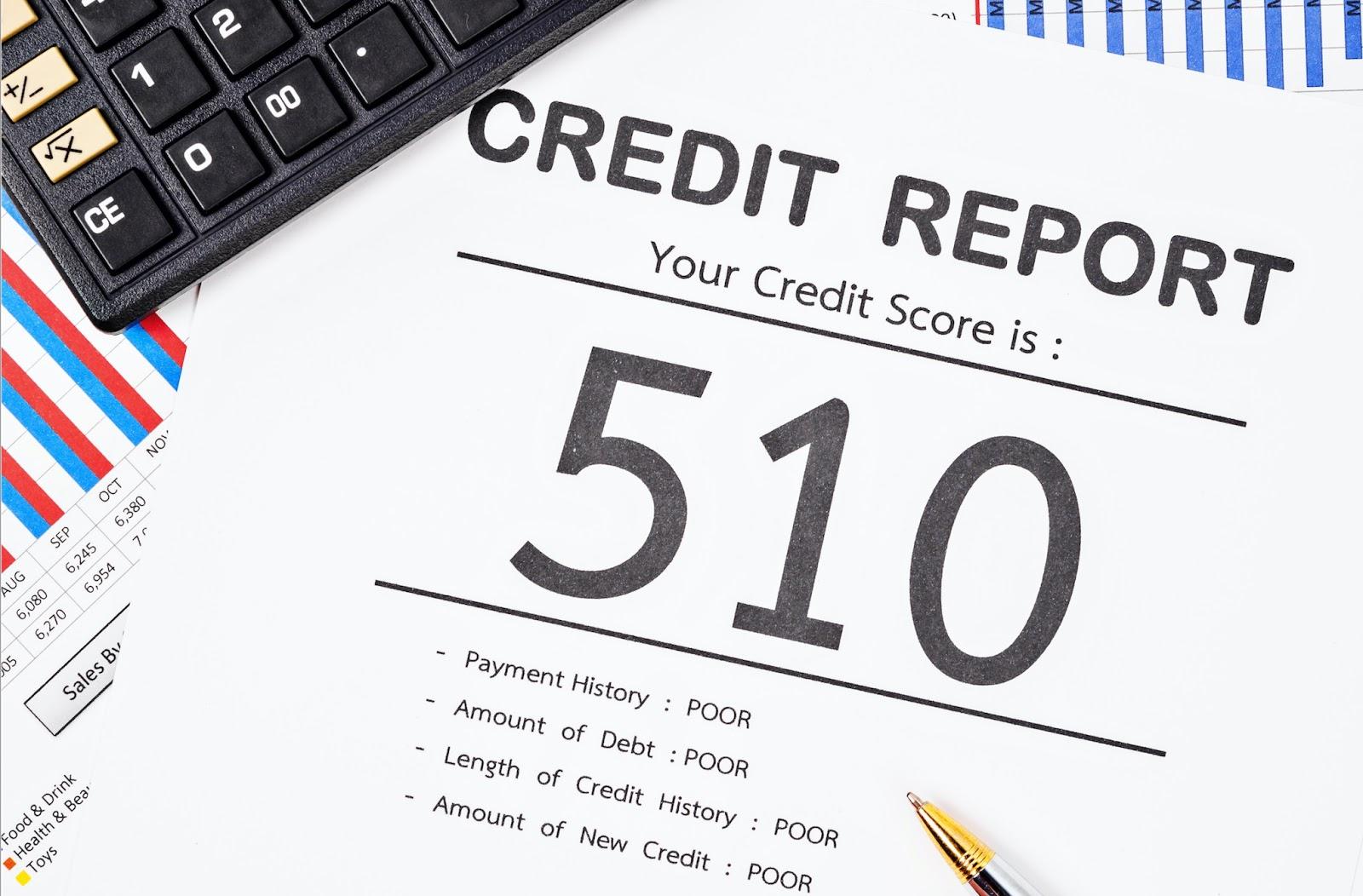

Imagine being able to borrow money without any hassles or unruly paperwork, so that you could buy your dream car or house. However, reality is far from such a scenario. Borrowing money from the bank depends on a number of factors – the most important being your credit score. A credit score is an indicator …

Continue reading “Preserving Your Credit Score: 7 Things To Watch Out For”

Among the many reasons for salary advances are the added expenses. But that’s not all where salary advances can prove to be useful. For instance, the rising costs may lead employees to borrow money from home or live a very frugal lifestyle towards the end of the month. But by getting a salary advance, they can …

Continue reading “5 Reasons a Salary Advance is All We Need”

We all want to become master of our money instead of being a slave to our habits, but let’s admit – we all give in to a lot of temptations. These temptations may seem fine at that moment because they’re relatively small, however, if you add them all together, chances are, you’re going to find …

Continue reading “Are you Guilty of These 15 Money-Wasting Moves? Here’s How to Stop”

Did this year’s tax leave you baffled? Did you feel like you paid way too much tax? Don’t blame the government or its policies, at least not yet! You may have overlooked a few essential things when filing your tax returns, which has resulted in low returns. Read on to what they are and steer …

Continue reading “How to Get More Money Back from your Tax Returns”

Investments are a very important part of retirement planning. This is also a very tense area that needs to be covered by couples. There are several studies conducted that show that bad investment planning is the reason for stress between many couples. For many, investment is just a monthly expense and they don’t feel the …

The current workforce consists of a considerable percentage of millennials. It is estimated in a study by the University of North Carolina that nearly 50% of the workforce will consist of millennials by the year 2020. With such a large proportion being millennials, the big question that arises is whether they are equipped enough to …

Continue reading “Making The Right Financial Choices Through Financial Literacy”