- Home

- Blogs

The Vibe Journal: Finance Blogs

From tax-saving tips, ways to manage your loan to personal finance — this is the ultimate finance blog for all your queries.

Moving to an entirely new city with no family support and warmth from your friends can get on your nerves. In contrast to our hometowns, most metro cities are typically taxing, making it harder to live and handle your expenses. You will need to manage a lot on your own. While we’ve shared money management …

Continue reading “Tips On Money Management To Survive in Metro Cities”

For Fibe, this was a logical evolution of all that we have done so far. After all, our goal has been to assist professionals in their quest for a happier life, backed by financial independence, and of course, the ability to meet emergency needs. At Fibe, we were beyond excited to announce the introduction of …

Continue reading “Simplify Your Loan Life: With the Fibe Credit Suite”

Both businesses and individuals often require credit. And this need has traditionally been fulfilled by banks (and their overdraft facilities) and large, established institutions. But thanks to advancements in several areas – technology, a rising startup ecosystem, and even market demand, short-term credit via loan apps have gained much popularity in addition to traditional methods …

According to a report on Millennials, by Morgan Stanley Capital International (MSCI), on a global level, millennials represent around 23% of the world population. millennials have a wide range of access to and knowledge of recent technologies, along with a fair idea of the investment options open to them. Even then, it is a tactful …

Education opens up more opportunities than any other investment ever well, as many doting parents would agree. Getting the best education indeed opens doors with no other keys. Oprah Winfrey has rightly said, “Education is the key to unlocking the world, a passport to freedom.” Parents wish the best for their children, and education tops …

Continue reading “How to Save and Plan for Your Child’s Education: A Guide”

If you have a low CIBIL score and are worried about getting a loan, the good news is – yes, you can still get a personal loan even with a low score. Many people search for personal loan for low CIBIL score or wonder how to get personal loan with low CIBIL score because they …

Continue reading “Personal Loan for Low CIBIL Score – Quick Approval Options”

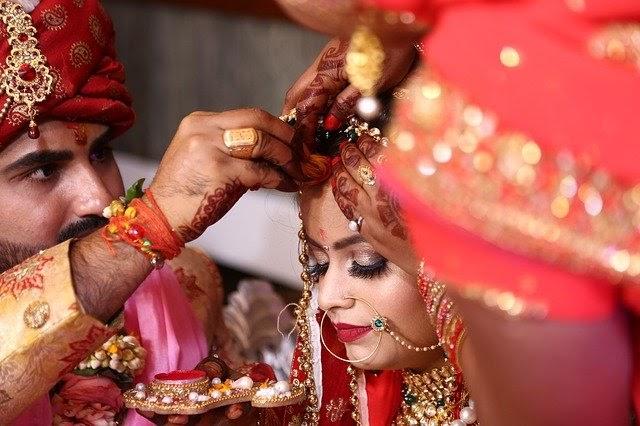

Wedding season is around the corner, and no one does weddings better than we Indians do with the whole “big fat Indian wedding” – a larger than life setup, designer outfits, extensive guest list, and a never-ending food menu. Since weddings are arguably one of the most memorable days for the bride and the groom …

Continue reading “Fulfill Your Wedding Dream With Fibe’s Wedding Loan”

With online personal loan applications, you can receive quick credit with minimal paperwork. The interest rates you get differ depending on various factors like your credit score and the lender. Some lenders also provide salaried individuals with personal loans pre-approved up to a certain amount. All such loans, though, can be categorised into short-term personal …

Continue reading “Long Term Or Short Term Loans: Which should you choose?”

Have you ever found yourself in situations where juggling between the many expenditures, investments, and savings just seems impossible? It often happens that in our busy everyday lives, we may not have a sense of how much we are spending. But for some of us, it is only when we run into financial troubles like …

Continue reading “Here’s How To Find The Right Balance Between Saving, Investing, and Spending”

In today’s time, financial wellness benefits have become a sine qua non for employee job satisfaction, no matter the designation, salary, or the industry. The importance of ensuring employee financial wellness is being recognized by every organization, be it a small startup or a multinational corporate organization. In fact, to know more about how great …

Continue reading “As an Employee, Why Should You Care About Financial Wellness Benefits?”