- Home

- Blogs

The Vibe Journal: Finance Blogs

From tax-saving tips, ways to manage your loan to personal finance — this is the ultimate finance blog for all your queries.

The festive season is finally here, and it brings with it much-awaited shopping sales. With the global pandemic, there has certainly been a slump in the economy as people have put off making big purchases. But as the economy restarts again, e-commerce giants like Flipkart and Amazon have geared up for major shopping sales. Let’s …

Continue reading “The best ways to save on big purchases this shopping sale”

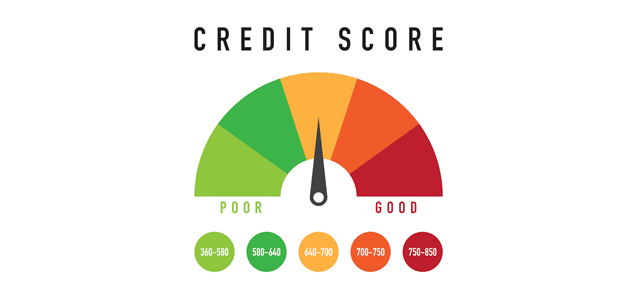

Based on your loan history (of all kinds), a credit score is a number that measures and rates your financial health. To decide whether to accept someone for a loan or credit card and to determine what interest rate to charge, lenders use credit scores. In order to decide whether to rent your house, give …

Continue reading “Know what your credit score says about you”

Over the years, an individual’s or even an organisation’s creditworthiness has come to be defined by their credit score. A loanee’s traditional data (e.g. credit history, types of credit, credit utilisation, etc.) is usually the only factor considered by credit scoring systems to evaluate their creditworthiness. The problem with this system is that a significant …

Continue reading “Alternative Data Is Now Mainstream in Credit Risk Analysis”

When it comes to loans, perhaps even before you finalise the loan amount, the first thing that comes to your mind is repayment. This is the right way to go about it as you are responsible for paying your loan on time. So, when you are borrowing, plan the budget accordingly and ensure that it …

Continue reading “5 Ways to Plan your Monthly EMIs on Instant Money Loans”

When applying for a personal loan, one of the biggest concerns borrowers have is understanding all the costs involved. What is the processing fee for personal loan? Are there any personal loan hidden charges that might surprise you later? Getting clarity on these questions helps you plan your finances better and repay without stress. Being …

Continue reading “Personal Loan Hidden Fees and How to Avoid Them”

A personal loan is an unsecured loan designed to help folks meet their financial needs. By definition, a personal loan is one where you don’t need to pledge any security or collateral while opting for it. The lender provides the borrower with the flexibility to use the funds as per their own requirements. On closer …

Continue reading “7 Life Goals You Can Achieve Using a Personal Loan”

When it comes to personal loans, instant approval is a characteristic no customer would decline. In fact, such a feature is prioritized. Fortunately, competitive credit markets give us plenty of choices. Based on your needs and requirements as a borrower, you can choose from a plethora of options available with banking institutions. SBI has several …

Continue reading “SBI Personal Loan Vs Fibe Loan: Which One Is Right For You?”

A Financial Wellness Program usually expands from standard employee benefits and goes past retirement arranging and contributing data. A balanced one will promote, for employees, everything from precise understanding and appropriate use of money to the point of building not just a stable, but symbiotic relationship with money. This is a perspective many evolving corporates …

Continue reading “How Great Companies Deliver the Best Financial Wellness Programs”

Thinking about repaying your personal loan early? Well, many borrowers want to know whether paying off a loan before time will save money or cost extra. The truth is, some lenders charge a prepayment penalty on personal loan when you close your loan early – either partially or fully. These are called pre closure charges …

Ever wondered why some women are better than the others at handling finances? Is managing money in a better way rooted in genes? Are some just more intelligent or more qualified? A bit of both perhaps. A 2017 Fidelity study shows that women save a larger proportion of their income than men. Another study built …

Continue reading “5 Habits of Women Who are Smart With Their Money”