- Home

- Blogs

The Vibe Journal: Finance Blogs

From tax-saving tips, ways to manage your loan to personal finance — this is the ultimate finance blog for all your queries.

Money saved is money earned – but you cannot apply this to funds left idle in the bank. Idle cash that does not generate any return or nominal returns may ultimately lose its value. But what causes money to lose value even when stored securely in your account? The simple answer is the decrease in …

Continue reading “Leaving your money in the bank You’re losing it!”

Obtaining a bank loan is a long and tedious process, involving a lot of documentation, numerous trips to the branch and a lot of effort. It also involves stringent credit checks, guarantors or collateral and a chance that the loan will not get approved. Banks also usually require a solid reason for providing the loan, …

Continue reading “What Fibe Does that Your Bank Just Won’t Do”

Procure a loan isn’t a walk in the park – traditional banks and financial institutions tend to take long periods of time to process loan applications. Apart from banks, informal money lenders are known for high rates of interest, making the entire process strenuous. Not surprisingly then, loan apps have emerged in this financial set …

Continue reading “A Comprehensive Comparison: Instant loan apps and services”

If you are looking at growing your money, the world of investments has no limits. While there are conventional methods of investment like fixed deposits, PFs, bonds and more, there are multiple alternative methods you may want to explore too. Non-traditional methods can surprise you and provide outsized results. Here are a few different types …

Continue reading “What are some non traditional ways to invest and grow your money?”

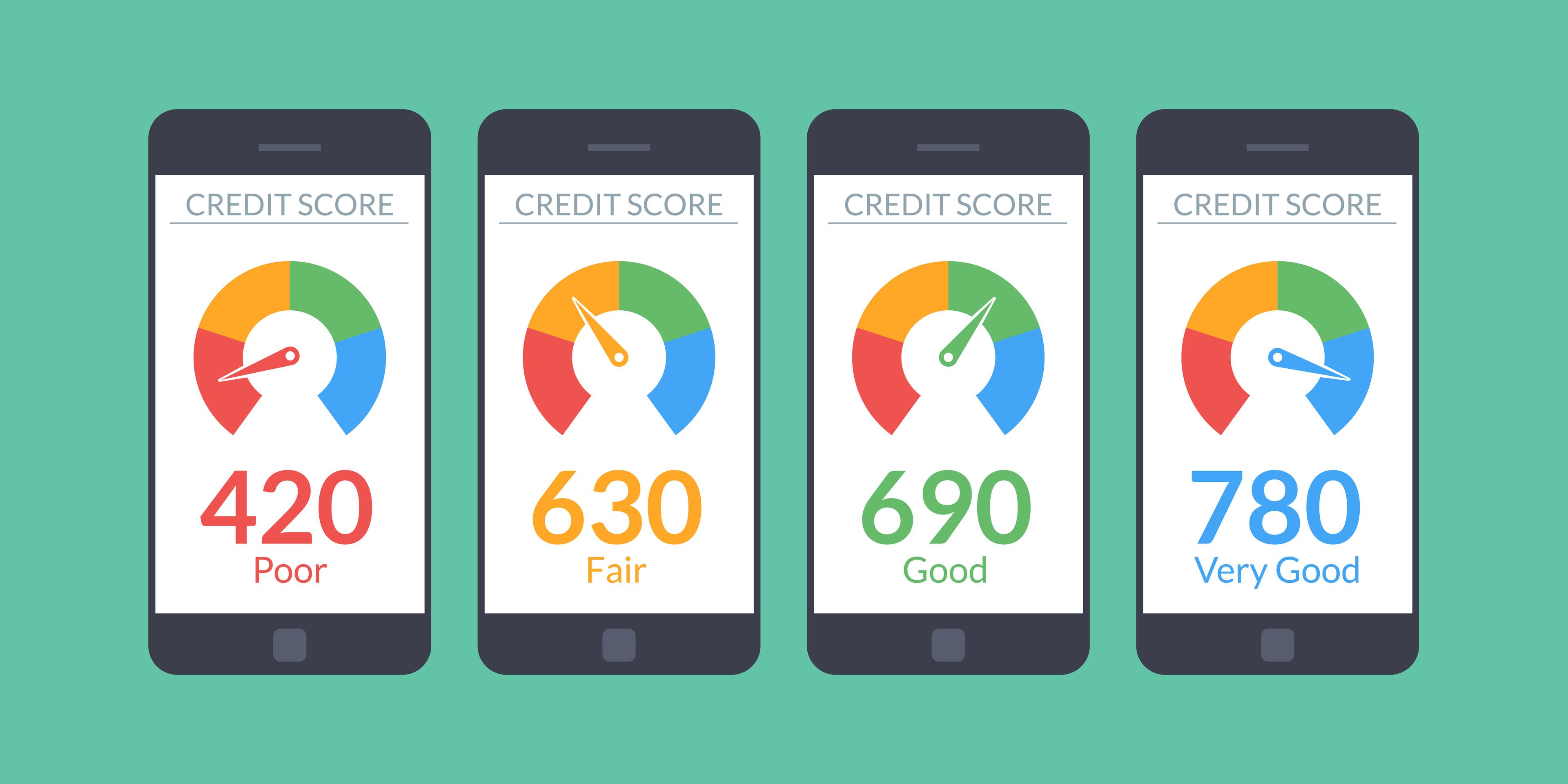

In today’s debt-driven economy, all individuals and business ventures depend on credit at one point or another. The credit score becomes essential in this context as it establishes the borrower’s creditworthiness and repayment history. Lenders are more likely to offer a loan or a credit card if your score is high. As such, you must …

Continue reading “How Instant Loans Can Boost your Credit Score”

Dreams of visiting exotic destinations are not uncommon, but travelling anywhere requires money, which we usually may not have in abundance. It is not easy to tick things off your bucket list when your bank balance is low, but it’s not impossible, either. We often end up spending tons of money unnecessarily by making unwise …

A fixed salary offers financial security that ensures your monthly needs are met. However, rising inflation rates may make it challenging to get through the entire month. As per an EY-Refyne survey, more than 80% of employees use up their entire salary before it is time to receive the next month’s salary. This can make …

Continue reading “Salary Advance vs Personal Loan – Choose a Loan that Works for You”

It is believed that living well and achieving dreams like buying a car, travelling or buying a home require quite a bit of financing as well as financial planning. Saving a bit of your income each month goes a long way if you wish to lead a comfortable life and be prepared for emergencies like …

Nothing in the world is as empowering as knowledge – the single biggest driver of economic growth globally. However, with rising costs of education, this development may go for a toss. Over 70% of students opt for higher education and fund a major chunk of their education with pricey loans. To add insult to injury, …

Just landed a new job and struggling to meet ends? Don’t know who to turn to for your temporary cash-crunch? A salary advance can be a panacea for all your liquidity problems. The concept technically refers to an early payment of a portion of an employee’s salary – but is often used to refer to …